Central and Local Income Adjustment Programs-October, 2019

the State Council issued a reform and promotion plan for income division between central and local governments.

Establish a long-term mechanism for VAT withholding and refund, and the share ratio between the central and local governments will remain unchanged during the Fifth Five-Year Plan. The local share (50%) of VAT withholding tax refund shall be adjusted from the total burden (50%) of the enterprise’s location to the first 15%. The remaining 35% shall be paid in advance by the enterprise’s location for the time being, and then distributed equally by all regions according to the share of the value tax of the previous year. The part with more than the share shall be transferred monthly from the central finance to the provincial finance of the enterprise’s location.

Part of the current consumption tax items levied in the production (import) link are gradually transferred to the wholesale or retail link to levy, so as to expand local income sources.

VAT Reform Implementatons-Mar.2019

Notice on Promoting the Pilot Program of Replacing Business Tax with Value-Added Tax -State Council 2016

Measures on transform of business tax to VAT-Mof & STA 2016

- Implementation measures on pilot transform of business tax to VAT

- Provisions on issues about pilot transform of business tax to VAT

- Provisions on pilot transform of business tax to VAT

- Provisions on zero VAT tax rate and tax exemption policy for cross-border taxable acts

Current Tax System

There are 18 different kinds of taxes in China, which can be divided into three categories according to their nature.

◆ Goods and services taxes, including VAT, Excise Tax, Business Tax, Vehicle Purchase Tax and Customs Duty. (See Table 3)

◆ Income taxes, including Corporate Income Tax and Individual Income Tax. (See Table 4)

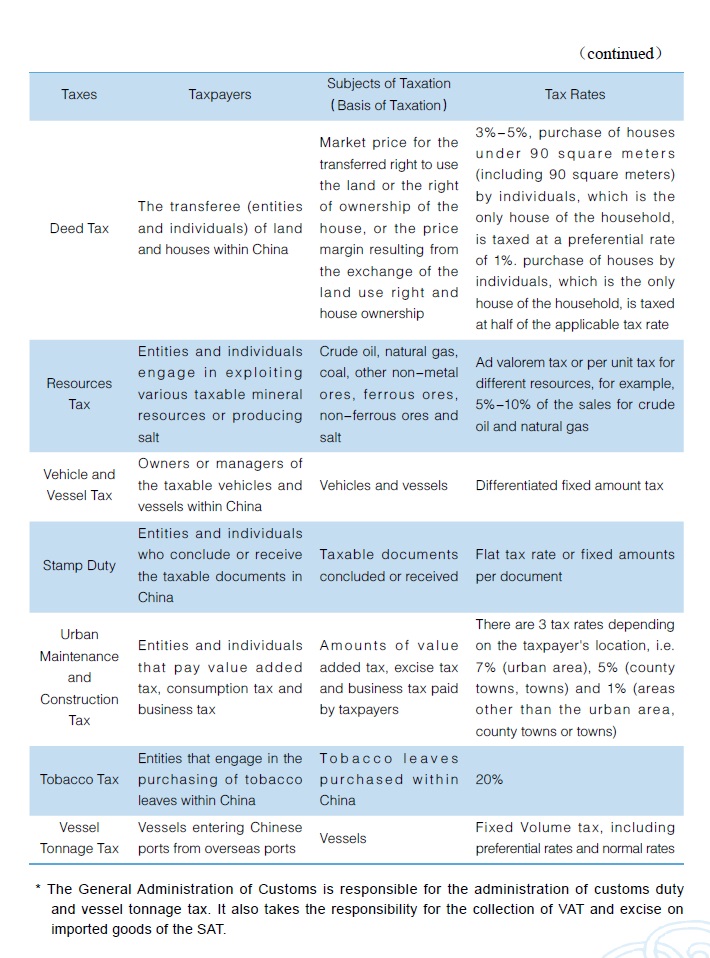

◆ Property and behavior taxes, including Land Appreciation Tax, Real Estate Tax,Urban and Township Land Use Tax, Arable Land Use Tax, Deed Tax, Resources Tax, Vehicle and Vessel Tax, Stamp Duty, Urban Maintenance and Construction Tax, Tobacco Tax, and Vessel Tonnage Tax. (See Table 5)

VAT Invoice Processing System